After well over three years without payments required on federal student loans, many borrowers may find it challenging to fit federal student loan payments into their budgets. With federal student loans in repayment again, millions of borrowers are at risk of delinquency or default. Addressing the needs of these former students is an increasingly important role for the financial aid office—and ScholarNet is happy to be able to help you with it.

How ScholarNet Can Help: Portfolio Navigator

Many financial aid offices may already be familiar with Portfolio Navigator. Built around the industry-standard Service Provider Loan Portfolio Detail report, Portfolio Navigator is a delinquency prevention and management solution that uses National Student Loan Data System (NSLDS) data to help financial aid professionals track the overall outlook of their federal student loan portfolio. Using this comprehensive data makes Portfolio Navigator a valuable resource for schools wishing to conduct CDR analysis. Using Portfolio Navigator’s Action Center, you can easily do targeted email, phone, or letter outreach by cohort and by repayment status, depending on your available time. You’ll be able to help borrowers stay on track in repayment and help protect your school’s cohort default rate (CDR) at the same time.

How Portfolio Navigator Works

Now accessed through your MyScholarNet portal, you can use Portfolio Navigator by uploading your NSLDS files (in .csv file format) into the secure solution. More specifically, you’ll need the schpr1.dat and delq01.dat files from NSLDS. After uploading, data for all your students and their servicers is made available to you in very usable ways, and Portfolio Navigator provides a real-time view of your estimated CDR today, as well as an estimated risk factor rate.

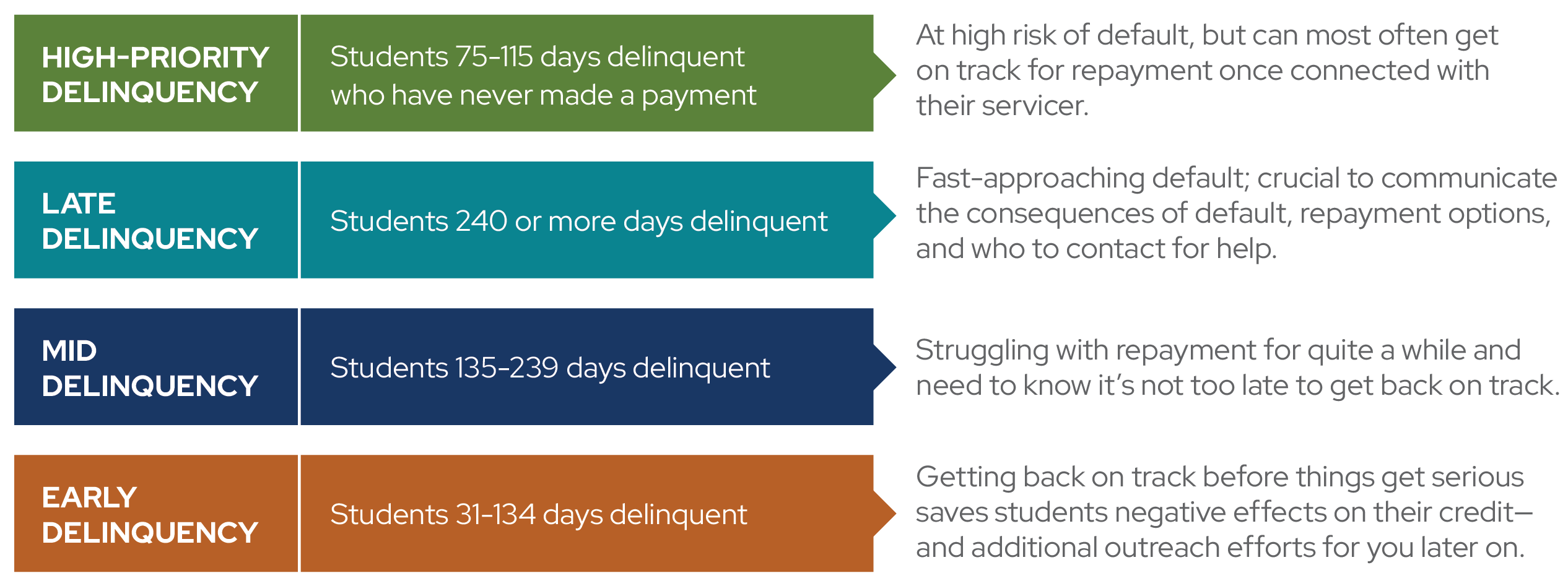

Borrowers are sorted into four categories to help you prioritize action you need to take to help them:

| HIGH-PRIORITY DELINQUENCY | Students 75-115 days delinquent who have never made a payment | At high risk of default, but can most often get on track for repayment once connected with their servicer. |

|---|---|---|

| LATE DELINQUENCY | Students 240 or more days delinquent | Fast-approaching default; crucial to communicate the consequences of default, repayment options, and who to contact for help. |

| MID DELINQUENCY | Students 135-239 days delinquent | Struggling with repayment for quite a while and need to know it’s not too late to get back on track. |

| EARLY DELINQUENCY | Students 31-134 days delinquent | Getting back on track before things get serious saves students negative effects on their credit-and additional outreach efforts for you later on |

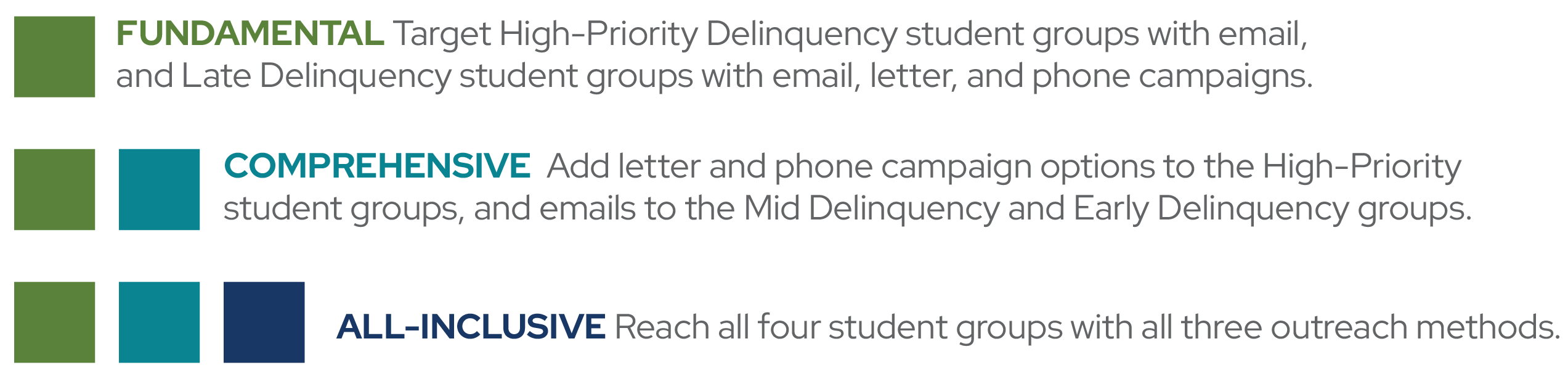

Outreach tools in Portfolio Navigator’s Action Center can be used flexibly to do targeted outreach to prioritized groups of borrowers. Three recommended action tracks maximize use of your valuable time:

- Fundamental: Target High-Priority Delinquency student groups with email, and Late Delinquency student groups with email, letter, and phone campaigns.

- Comprehenvise: Add letter and phone campaign options to the High Priority student groups, and emails to the Mid Delinquency and Early Delinquency groups.

- All-Inclusive: Reach all four student groups with all three outreach methods.

Action Center provides email, letter, and call campaign options to guide your message to each of the targeted groups. You can use our flexible correspondence templates to do your own mail merge or choose to use ready-made PDFs. Portfolio Navigator eliminates the need for expensive delinquency and default management programs and services.

Portfolio Navigator: Complimentary to Schools Using ScholarNet

We’re proud to offer tools like FastChoice™ and ScholarNet® that allow you to customize private loan processing to the way your financial aid office handles private loan selection, certification, and disbursement. These flexible solutions are supported by dedicated representatives and a Care Team made up of experts who understand your needs.

Portfolio Navigator is a complimentary service to schools that use ScholarNet as their primary processing solution. We’re happy to provide a way for ScholarNet customers to proactively and efficiently manage their delinquency outreach process.

Please contact your ScholarNet representative or the Care Team to get your access to the tool and with any other questions you have about getting started with Portfolio Navigator.