CDR Analysis and Effective Outreach

Portfolio Navigator

Portfolio Navigator is a comprehensive and secure data-driven portfolio management tool that offers prioritized outreach plans and tracking. You can upload, view, and filter your National Student Loan Data Service (NSLDS) data to track your federal student loan portfolio and, as a trusted partner, you can reach individual students who need your help, using less than an hour a month.

How Portfolio Navigator Works

Use Portfolio Navigator to view your federal student loan portfolio, estimated CDR, and estimated risk factor rate. With Action Center, use your portfolio data to send targeted, timely messaging to prioritized student groups in key channels.

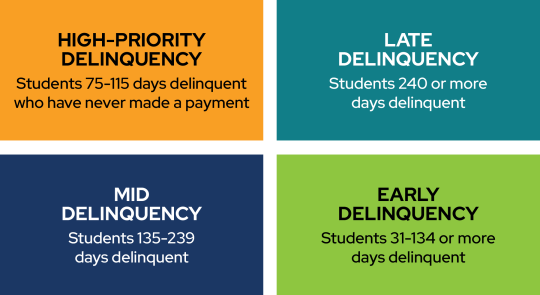

Track by Delinquency Stages

HIGH-PRIORITY DELINQUENCY

Students 75-115 days delinquent who have never made a payment

LATE DELINQUENCY

Students 240 or more days delinquent

MID DELINQUENCY

Students 135-239 days delinquent

EARLY DELINQUENCY

Students 31-134 days delinquent

Data for student groups can be viewed, tracked, and used to take targeted actions to reach borrowers by delinquency stage, no matter who their federal loan servicer is.

Choose Your Outreach Method

Use Action Center’s flexible email, letter, and call campaigns to guide messages to each targeted group based on their delinquency stage. You can customize or use ready-made PDFs.

Manage Time With Action Tracks

Action Center’s three Action Tracks help you prioritize your outreach and maximize use of your available time by targeting groups with key outreach methods.

- Fundamental: Target High-Priority Delinquency student groups with email, and Late Delinquency student groups with email, letter, and phone campaigns.

- Comprehensive: Add letter and phone campaign options to the High Priority student groups, and emails to the Mid Delinquency and Early Delinquency groups.

- All-Inclusive: Reach all four student groups with all three outreach methods.

Get Started With Portfolio Navigator

Portfolio Navigator is complimentary to you if your primary private loan processing platform is ScholarNet. To learn more about Portfolio Navigator, or to get started with ScholarNet and Portfolio Navigator, reach out to your sales representative today.